1. Analysis on the current situation of China-USA trade: China's dependence on the us trade has decreased

Since China's entry into the WTO, the trade imbalance between China and the United States has increased year by year. The absolute value of the trade imbalance between China and the United States continues to expand, as evidenced by China's trade surplus in goods with the United States and the United States' trade surplus in services with China. On the one hand, China's trade surplus in goods with the United States rose from $29.8 billion in 2000 to $278 billion in 2017. On the other hand, since the financial crisis, China's economic dependence on the international trade have fallen: goods trade surplus accounted for the proportion of China's GDP is inverted u-shaped trend, before the financial crisis in 2006 reached a peak of 5.2%, after falling, the surplus in 2016 accounted for the proportion of China's GDP is only 2.3%; The trade deficit with China in goods as a share of U.S. GDP has been on the rise for nearly two decades, rising from 0.8 percent in 2000 to 1.9 percent in 2017.

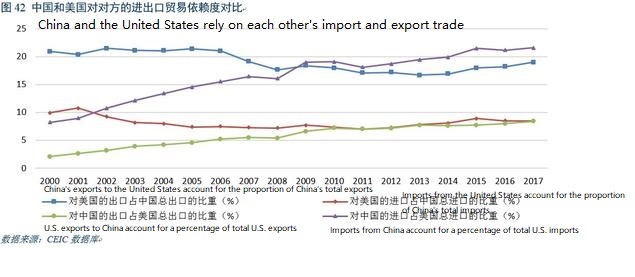

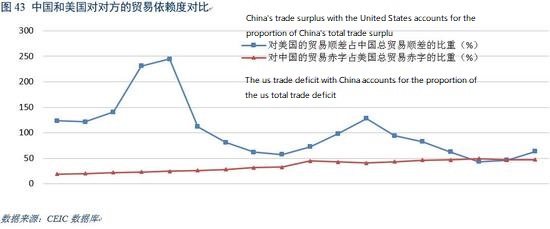

In addition, although China and US are important trade partners, but after the financial crisis, because of the diversification of the export partners, China's trade dependence on the United States has fallen significantly, while the United States is increasingly dependent on China for imports and exports. When China joined the WTO in 2001, exports to the United States accounted for 20.4 percent of China's total exports, and imports from the United States accounted for 10.8 percent of China's total imports. In 2017, China's imports and exports to U.S accounted for 18.9% and 8.4% of China's total imports and exports respectively. Contrary to this trend, the proportion of U.S. exports and imports to China rose from 2.6 percent to 8.4 percent and from 9.0 percent to 21.6 percent in the decade from 2001 to 2017. The rapid expansion of trade with China, especially imports, has led to U.S trade deficit with China rising from 20.2 per cent in 2001 to 47.1 per cent in 2017. China's trade surplus with the United States as a proportion of China's total trade surplus has been significantly reduced in recent years. Before 2006, China's trade surplus with the United States even exceeded China's total surplus, indicating China has deficit overall with other countries. However, this trade dependence on the United States is rapidly diminishing with the diversification of China's export partners, with China's trade surplus with the United States accounting for 63.5 percent of its total trade surplus with the United States in 2017.

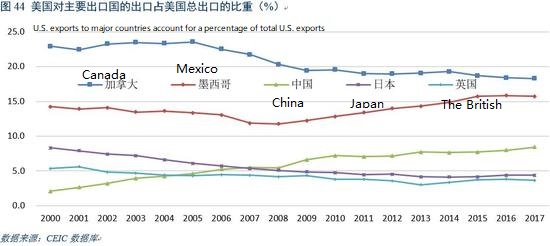

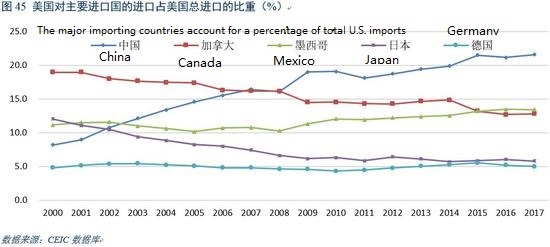

In recent years, the destination countries for China's imports and exports have become more diversified. From 2000 to 2017, China's export share to asean countries increased from 6.9 per cent to 12.4 per cent. Because of the economic development of the necessary raw materials, the expansion of demand for oil and other commodities, China from Latin America, Africa, Oceania and other imported commodities reserves rich region is also expanding rapidly, the squeezed the share of China's trade with the United States. , by contrast, the United States on China's import and export demand is more robust, with China's expanding trade squeezed the trade between America and Japan, Canada and other countries share, also makes America's trade deficit with China is widening.

We believe that although looked from the total amount of China's trade surplus with USA, the surplus is still expanding, the United States remains China's largest trading partner, trade war would undoubtedly have great influence on China's foreign trade and economy as a whole. However, China's dependence on the USA trade has dropped significantly. The decisive role for trade with the United States is waning as China becomes more diversified and increasingly traded with other trading partners. Therefore, while recognizing the seriousness and difficulty of a trade war, China should respond calmly and maintain strategic determination, not panic.

2、The influence and Countermeasures of trade war

According to the U.S. department of commerce, the total value China's exports to the U.S. are $505.6 billion in 2017, while the total value China's imports from the U.S. is $130.4 billion. The average tariff on Chinese exports is now around 3 per cent, which will rise to 25 per cent when a trade war begins. According to the research on China's foreign trade in recent years, the average value of China's export price elasticity is about 0.5. Assuming that China doesn't retaliate, after this tariff is imposed, the value China exports to the United States will be down 11%, which is $50 billion. Now China's GDP is $12 trillion, so this drop in exports would drag China's GDP down by 0.4%. According to relevant research and calculation in recent years, China's import price elasticity is 0.48. If China imposes the same level of retaliatory tariffs on us goods, the direct impact on China's net exports will fall to 40 billion and the drag China's GDP down to 0.34%.

Table 3. The most traded products between China and the United States (2017)

|

The major goods China imports from U.S |

Imports value (100 million USD) |

classification |

The major goods China imports from U.S |

Imports value (100 million USD) |

classification |

|

Airplane , Flight equipment |

162.7 |

Machinery and transportation equipment |

Communications equipment |

826.9 |

Machinery and transportation equipment |

|

Oilseeds |

124.1 |

Raw materials (excluding fuel) |

Automated digital processing equipment |

505.1 |

Machinery and transportation equipment |

|

car |

106.2 |

Machinery and transportation equipment |

Baby carriages, toys, games and sporting goods |

262.5 |

Miscellaneous products |

|

Hot electron and cold stage tube |

59.3 |

Machinery and transportation equipment |

Office equipment, data processing machines |

153.5 |

Miscellaneous products |

|

Mineral oil, crude oil |

44.3 |

Fossil fuels, lubricants and others |

Mechanical and electrical equipment |

141.3 |

Machinery and transportation equipment |

Table 4. Changes in China's major crude oil importing countries over the past decade

|

|

2008 |

2012 |

2017 |

|||

|

ranking |

countries |

Accounted for |

countries |

Accounted for |

countries |

Accounted for |

|

1 |

Saudi Arabia |

20.1 |

|

20 |

Russia |

14.6 |

|

2 |

Angola |

17.4 |

|

15.1 |

Saudi Arabia |

12.7 |

|

3 |

Iran |

12.3 |

|

9.3 |

Iraq |

12.1 |

|

4 |

Oman |

8.8 |

|

8.1 |

Angola |

8.5 |

|

5 |

Russia |

6.7 |

|

7.2 |

Oman |

7.5 |

|

6 |

Sudan |

4.9 |

|

5.7 |

Iran |

7.4 |

|

7 |

Kuwait |

3.3 |

|

4.7 |

Brazil |

5.4 |

|

8 |

Kazakhstan |

3.2 |

|

4.0 |

Kuwait |

4.4 |

|

9 |

Venezuela |

2.7 |

|

3.8 |

Venezuela |

4.1 |

|

10 |

The united Arab emirates |

2.6 |

|

3.4 |

The united Arab emirates |

2.5 |

In addition to the direct impact, we also took into account the multiplier effect of trade wars on the overall economy. In our view, the multiplier effect is limited in the short term. As most production factors of enterprises have been determined in the short term, the impact of trade wars cannot be transmitted to investment quickly. In the long run, trade wars will have a certain negative impact on enterprise investment and employment, but considering the hedging of RMB depreciation, the impact will not be great.

The real risk is that the trade war despite the direct impact to China's economy is not strong, but for a long time may bring the deterioration of global free trade trend, trigger a chain reaction in the current of economic globalization. This will make the normal technology investment exchanges in China have the risk of slowing down, and China's technology upgrading and industrial upgrading will face great challenges. Therefore, although China has the sincerity to trade negotiations with the United States, but at the same time for the response and preparedness, once the trade war really start, try to minimize the adverse impact on the economy. We have two Suggestions.

First, we should firmly grasp the initiative, turn passivity into initiative, and promote peace through war. The short-term nature of the trump administration makes it difficult for the trump administration to bear the consequences of a sharp short-term downturn in the U.S. economy. The US faces a mid-term congressional election in November 2018, and Mr. Trump must be wary of the short-term direction of the US economy if he is to win re-election. Therefore, China can take the initiative to put forward controllable solutions to solve the domestic economic difficulties and achieve win-win results through proactive response, so as to transform the passive situation and gain bargaining chips.

In order to understand the current situation of trade imbalance between China and the United States, we further classify the industries. As shown in table 1, the volume of a single product China imports from U.S. is much lower than that of a single product exports to the United States. The most of goods China imports from the United States mainly are in machinery and transportation equipment, among them, the import value of airplane, aerocraft equipment, and cars all have exceed $10 billion. In addition to machinery and transportation equipment, the products with higher import volume include oil, non-ferrous metal waste and other raw materials, as well as fossil fuels such as shale gas. The main exports goods to the United States are mainly in the field of machinery and transport equipment and miscellaneous products, among these, the export value of machinery and transport equipment exceed miscellaneous products, as the main export industry. In 2017, China's main export products to the United States are communication equipment and automatic data processing equipment, both of which belong to the machinery and transportation equipment industry.

In 2017, China imported 1.21 million cars, while the U.S. produces 12.1 million cars a year. Other things being equal, it is estimated that an increase of 3m Chinese car imports to the us would reduce the trade surplus with the us by nearly $100bn. It is estimated that if other conditions remain unchanged, if China imports 3 million more cars from the United States, it will reduce the trade surplus with the US by nearly US $100 billion. According to estimates, in 2017, the total of three Detroit giants in North America reached a total of 8 million 600 thousand units, while foreign vehicles and Tesla production in North America would reach 8 million 700 thousand. Foreign car companies in the US have already exceeded the US local car companies, and the gap is expanding. The United States can fully meet the expansion of the demand by promoting the further development of foreign-funded car companies, and achieve a win-win situation with China.

In addition, China's dependence on U.S. fossil fuel imports has repeatedly hit new highs in recent years. With the continuous improvement of shale oil mining technology in the United States, China's oil imports from the United States have grown in a blowout style. In 2008, China's crude oil imports from the United States was only $2 million 500 thousand, but the value of import crude oil in 2017 was up to $3 billion 150 million. The proper expansion of crude oil imports from the US will help diversify our import energy structure, reduce energy dependence on individual countries and ensure China's energy security. The following table shows the changes in the structure of China's crude oil imported from the 10 major importers in the last ten years. It is seen from the table that the concentration of China's crude oil imports is decreasing. In 2008, the first five and the first ten crude oil importing countries accounted for 65.3% and 82.1% of the total crude oil imports, while the corresponding proportion in 2017 dropped to 55.5% and 79.3%, respectively.

At present, China consumes 6 billion tons of crude oil in the year, in 2017, crude oil imports exceeded 4 billion tons, while the annual output of American crude oil is over 5 million tons in 2017. Estimate one ton is equal to seven barrel, If the annual increase of 2 million tons of crude oil imports from the United States, assuming that other conditions remain unchanged, it will also reduce the trade surplus with the United States by nearly US $100 billion.

If the United States sincerely negotiate and cooperate with China on the trade imbalance between the two countries, China can take the car and crude oil as a breakthrough, balance the trade between China and the United States, and promote domestic consumption in China and enhance the capacity of the United States to solve the employment of industrial workers. Since the auto industry will have a pulling effect on the economy and employment of many states in the United States, and it is highly involved in the vote, China can consider this as a bargaining chip for the United States.

Second, improve the business environment and expand the domestic market. At present, China is already the world's factory, the output value of the global manufacturing industry in 2015 is 12 trillion and 157 billion US dollars, while China is 3 trillion and 250 billion US dollars, accounting for 26.73% of the world, and 30% in 2017. By maintaining a 6% growth rate, China's manufacturing output accounts for 40%-45% of worlds by 2025. However, the trade war between China and the United States shows that the non market resistance of China's manufacturing industry expansion will continue to increase, that is to say, the potential of relying solely on manufacturing to promote China's development is very limited. In order to further expand the domestic market, China should increase imports from other countries such as the European Union, Asia, Africa and other countries while competing with the U.S., disintegrating goals of U.S drawing some countries by offering the "exemption tariff", striving for international support and isolating the United States as far as possible. China should deepen the reform, unswervingly improve the business environment, strive to leave enterprises at home, promote domestic consumption upgrading, expand the domestic market, and promote the transformation of China from a simple manufacturing power to a "manufacturing power" and a "consumer power", with greater determination and bravery to promote a new round of reform and opening up.