Steel demand from China's manufacturing industry is expected to grow by 3% in 2018.

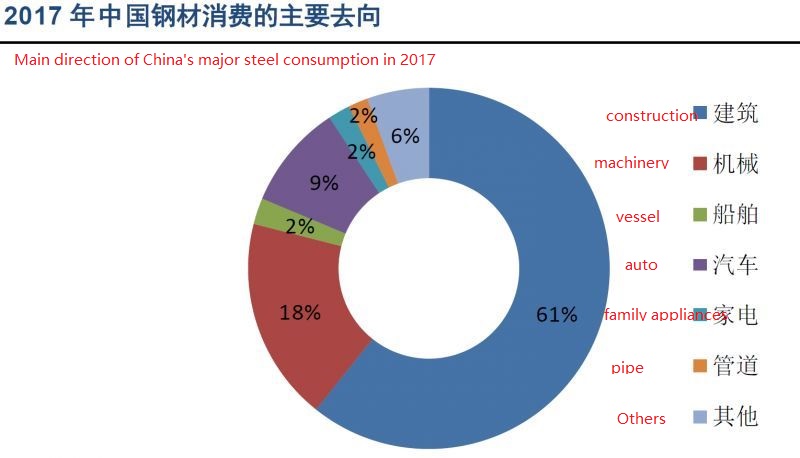

According to the steel terminal consumption statistics of Mysteel, the steel consumption is mainly in the fields of real estate, infrastructure and manufacturing with large investment in fixed assets:

· Real estate and infrastructure consumption accounted for about 61%, mainly wire and steel; Mainly for building steel structure and concrete reinforcement.

· Industrial equipment accounts for about 22% of the total consumption, mainly hot-rolled and heavy and medium plate products, such as construction machinery, shipping and marine engineering, oil and gas power and other fields; It mainly for manufacturing produces various welded steel structures, such as equipment shells and frames, pressure vessels, steel pipes, bridges and other structural products.

· The proportion of automotive steel is about 9%, mainly hot-rolled and cold-rolled products; mainly for sheet metal parts and light steel structural parts, such as automotive chassis are light steel products, shell is sheet metal products, and also other small sheet metal parts and stamping parts.

· Home appliances accounted for 2%, mainly in cold rolling. It is mainly the sheet metal products, the shell of various household appliances.

· Other industries accounted for 6%.

The demand for steel for manufacturing in China is expected to increase by 3% in 2018.

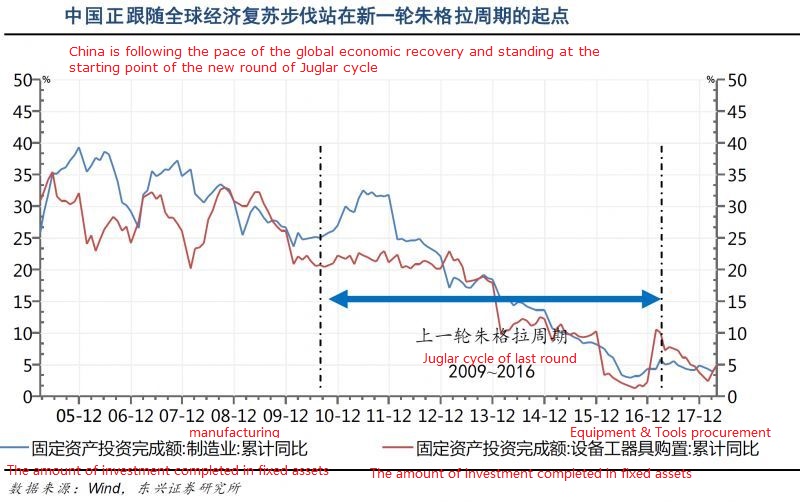

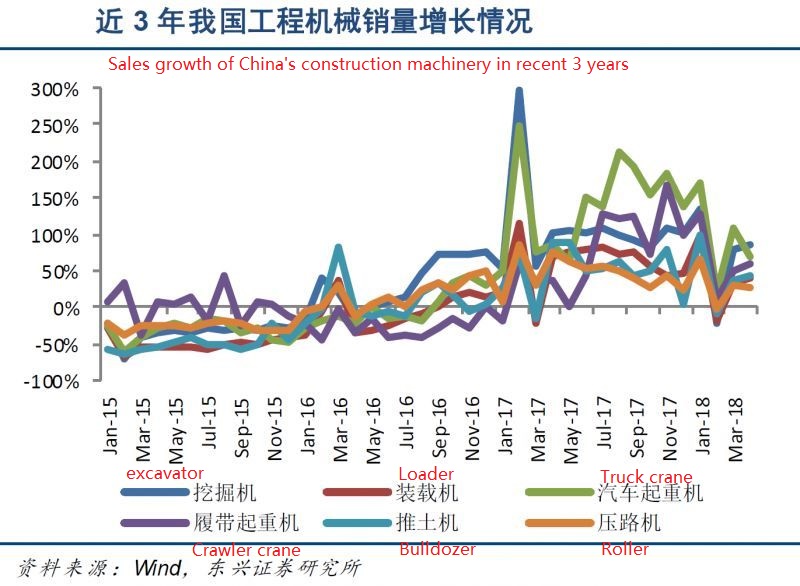

l Mechanical steel needs increased by 1.5%. From the perspective of equipment investment, the world has entered a new round of jigra cycle since 2016. In economies represented by the United States and Japan, equipment investment continued to increase year on year, leading to high external demand. The sales volume and export volume of construction machinery in China increased significantly, with demand for steel used in construction machinery increasing by 1.6 percent in 2017. In the first quarter of 2018, the output and sales of construction machinery grew by nearly 30% year-on-year, and the export increased by nearly 100% year-on-year. The demand for mechanical steel continued to stabilize and improve. With the economic recovery and the improvement of export of machinery and equipment, the orders and profits of China's supporting machinery processing suppliers are also increased and improved, such as machining parts, welding structural parts, sheet metal parts and other related machinery supporting manufacturers.

l Energy demand for steel increased by 10%. The production and sales of energy steel have a strong correlation with the price of oil. In 2017, the price of crude oil rose to $80 from $60, and the sales of steel pipe increased by 5.3%. Under the background of global economic recovery and complex international environment, all major institutions are predicting that oil prices will continue to rise, benefiting steel pipe production and sales volume.

l Shipping and marine steel sales increased by 6%. Ship and offshore (drilling platform) are heavy steel structure products; they are large consumers of steel materials. In 2017, orders for new ships in China increased by 60 percent year-on-year, handhold orders decreased by 12 percent year-on-year, and steel demand for ships increased by 6 percent. In the first quarter of 2018, orders for new vessels increased by 180%, orders for hand-held vessels increased by 7% compared with the same period in 2017, and demand for ships and marine steel is expected to continue to grow in 2018.

l Automobile steel increased by 4%. Automobile steel plates are mainly thin steel plates, and their products are mainly sheet metal products and stamping parts. In 2017, the production and sales volume of China's automobile industry increased by 5% year-on-year, and the demand for automobile steel increased by 4.6%.Vehicle production and sales growth is expected to fall back to 3% in 2018, but from the growth structure, SUV models increased by 9.6% year-on-year in the first quarter, cars decreased by 1.72% year-on-year, however, SUV consumes nearly 0.4 tons more steel than ordinary cars, which is conducive to the increase of automobile steel consumption. It is estimated that the demand for automobile steel will increase by 4%.

l Steel for household appliances increased by 2%.In 2017, the demand for steel for household appliances increased by 2.3%, and "renewal demand" became the main theme of consumption upgrade in China's household appliances industry. Steel consumption form big electrical appliances account for 80% in household appliances industry, and China is experiencing a new round of consumption upgrade, high-end household appliances and smart appliances become a new growth point, the addition of new consumption and upgrading consumption will bring considerable consumption of home appliances and improve the demand for steel for home appliances. "Renewal Demand" also brings considerable orders to China's hardware and machinery suppliers, such as sheet metal processing suppliers, stamping parts suppliers, surface treatment suppliers and other supporting suppliers, thus driving the prosperity of the real industry.

- The current situation of China's major manufacturing industries

China is following the pace of the global economic recovery and standing at the starting point of the new round of Juglar cycle

- Supply side structural reform and upgrading to reduce effective supply

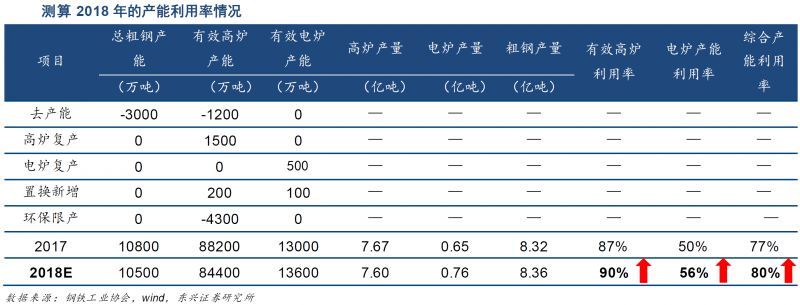

In the context of supply side structural reform in steel industry from capacity reduction to environmental protection upgrading, It is estimated that total crude steel production capacity and effective blast furnace capacity will be reduced by 30 million tons and 38 million tons respectively in 2018, and effective electric furnace capacity will be increased by 6 million tons.

After the supply-side structural reform of the steel industry in 2016-2017, the backward production capacity represented by "tiebanshan iron and steel" has been basically cleared. In 2018, the supply-side structural reform of the steel industry has not weakened, and the reform is further deepened from administrative capacity reduction to environmental protection production restriction, and the change of industrial marginal conditions is still going on.

- The new logic of "only raise the price of steel, not the raw material"

Under the influence of supply-side structural reform forces, the steel industry has entered a new cycle and shown new changes, which are mainly reflected in the diverging trend of steel price and economic fundamentals,as well as the steel price and raw materials price.

Since 2015, the price of steel products started to deviate from the GDP growth rate, and steel prices continued to rise, which changed the good linkage between steel prices and GDP growth in previous cycles.

The differentiation of steel price and raw material price has led to the situation of "only raising steel price and not raising ore price". As the upstream and downstream of steel price and raw material price originally have strong synergy, demand driven steel price often leads the raw material price rise. Under the new cycle, the steel demand is basically stable, which to some extent inhibits the demand for raw materials. The steel price rise is mainly driven by the supply-side reform, which weakens the synergy between products and raw materials.