The end of the year is coming and 2017 is coming to an end. The price differentiation between different kinds of steel in China is obvious this year, from March of first half year, the price of plate and coil fell sharply, with the largest decrease of 1000 yuan / ton, while the price of rebar was rising steadily, the increase this year was the largest in nearly 5 years, and prices in some markets in December were even higher, further driving other types of steel have different range of up - regulated. However, this does not seem to be a good thing for our country's exports. Next, the author makes a brief description of the changes in export situation this year, the impact of domestic steel price increase on export, and whether "One Belt And One Road" can become a new growth point.

One: The export of steel shows a downward trend

As can be seen from the figure, from the end of 2016 to 2017, China's steel export volume as a whole shows a downward trend. In October, steel exports were 4 million 979 thousand tons, the lowest since March 2014, and the average export price of steel prices was $798.84 per ton, the highest value since February 2014.

Figure 1: export volume of steel in 2017

As we all know, price is one of the most important factors in export competition. In 2015, steel exports hit a historical peak; the reason is also related to the low level of steel prices in 2015. However, with the policy of environmental protection and limited production, and banning “ditiaogang” — low-quality steel made from scrap metal and the continuous advance of the supply side reform, and the price of steel has begun to warm up. The whole year is basically on the rise, and gradually changing to high value-added products, which also makes the export of low value-added products shrinking. On the other hand, in view of the dramatic increase of China's anti-dumping cases, the increase of trade frictions encountered by China's exports is another reason for the reduction of China's exports.

Some cases of anti dumping in China in 2017:

1. the Ministry of industry and trade in Egypt recently announced that from June 2017 (provisional expropriation) to June 2022, the tariff rate of anti-dumping duties on China and China's imported steel products increased from 17% to 29% from the temporary levy.

2. the Turkey government communique said in November 29th that it had imposed anti-dumping duties on 16.9-22.6% from flat non-rolled steel imported from China.

3. India imposes anti-dumping duties on certain painted flat materials imported from China and the European Union for a period of five years.

4. Malaysia announced that temporary anti-dumping duties on cold rolled stainless steel imported from China, South Korea, Thailand and Taiwan, China, were levying a tax rate of 7.27%-111.61% for a period of no more than 120 days.

5. Beginning in September 5th, the Ministry of industry and trade of Vietnam decided to impose anti-dumping duties on H steel, which is originally produced in China, for a period of 5 years. The anti-dumping duty rate is lower than the provisional anti-dumping duty rate ended in August 2nd.

6. EU anti-dumping duty on major steel varieties in China

|

Main varieties |

Anti-dumping duty rate |

Countervailing duty rate |

Time of arbitration |

|

Hot rolled coil |

18.1%- 35.9% |

|

April 6, 2017 |

|

Hot rolled medium and thick plate |

65.1% - 73.7% |

|

February 28, 2017 |

|

Galvanized sheet |

17.2% - 28.5% |

|

August 9, 2017 |

|

Seamless steel tube |

29.2% - 54.9% |

|

May 12, 2017 |

Two: Countries along the One Belt And One Road may become new growth points

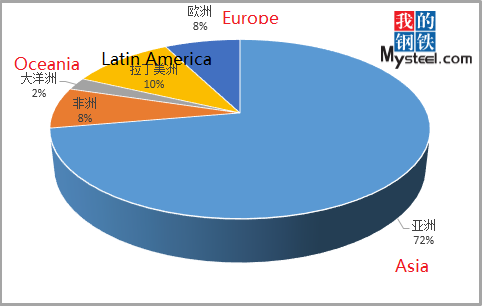

Figure two: the proportion of the steel export area in the month of 1-11 months of 2017

As can be seen from the chart, the main export areas of China's steel are mainly in Asia, while in the country, South Korea, Vietnam, Philippines, Thailand, Indonesia and other exports are in the front. But in the case of countries along the One Belt And One Road, Vietnam, the Philippines and Thailand are the three major export destinations, with exports of 11.66 million tones, 6.51 million tones and 6.21 million tons respectively, up 15 per cent, 16 per cent and 31 per cent year-on-year. The volume of exports to India, Turkey and Iran is more obvious, mainly because these countries add more capacity domestically, and protect domestic steel enterprises, and then increase the import tariff of steel.

According to statistics, China exported 63.79 million tons of steel to countries along the "One Belt And One Road" in 2016, an increase of 3% over the previous year, but Exports to countries outside One Belt And One Road totaled 44.64 million tons, down 11 percent from a year earlier, thus, the "One Belt And One Road" steel demand situation is better than other regions. According to the relevant report, there are about 400 core projects related to One Belt And One Road, which will also drive the demand for a large amount of steel. For example, in the Thai-china railway cooperation project, the railway from Bangkok to Herat is 252 kilometers long, with a designed speed of 250 kilometers per hour and a total investment of about 179 billion baht. Thailand plans to split the project into four phases, which are 3.5 km, 11 km, 119 km and 119 km respectively. The cooperation of the project is accompanied by the output of technology, which will directly or indirectly stimulate the export of China's steel, which will become a new growing area for China's steel exports.

Three. Summary

As a big producer of steel, China has been impacted by trade frictions and anti-dumping in recent years. In 2016, China's steel exports to India dropped by 30% over the same period last year, and trade surveys were launched against China's steel varieties. After launching anti-dumping and countervailing cases against China’s steel in the United States, China's exports of American steel are also declining. It is worth noting that, with the proposal of the "along the road" initiative, the overseas orders of Chinese construction enterprises have been maintained at a high level, which is expected to produce 1.5 million tons of steel demand next year. From this point of view, the next country along the "one road" along the country's steel demand potential is huge, or will become a new area of China's steel exports.