1 Analysis of the development status of China's steel structure market

China's steel structure industry has undergone a shuffle period, some small enterprises were eliminated by the market, leading enterprises increased market share.

Since 2013, the profit growth rate of China's steel structure manufacturer has been shrinking continuously, the total profit in 2013-2015 was 13.5 billion, 14.6 billion and 15.48 billion respectively, and the growth rate was 20%, 8.2% and 6% respectively, profit margin continued to decline, and the profit margin of whole industry was only 3.15% in 2015, industry loss rate reached 11.3%. Small and medium-sized steel structure manufacturers due to backward machinery and equipment, product simple and single, low prices, low profit margins, coupled with the continuous decline of industrial profit rate, the net profit per capita of the three-tier qualified enterprises was only 11,000 yuan in 2015, the original price advantage was no longer obvious, and the business volume was greatly reduced. In 2015, the business volume of small and medium-sized enterprises decreased by 15% to 35% , production was very difficult, and the company's operating rate was insufficient, so it could only be eliminated by the market. Compared with this, the leading steel structure manufacturers with the advantage of technology, design, capital and so on, their products have high added value and sound allocation of resources, and enterprises have economies of scale and higher profits, the per capita net profit of special enterprises reached 41 thousand in 2015. Through the fierce competition in the industry, the operation capacity and professional technology of the leading steel structure manufacturers have been improved, the strength has been enhanced, and the competitive advantage is more obvious. After fierce market competition, some small and medium-sized steel structure manufacturers were eliminated, the market share of leading steel structure manufacturers has been increased.

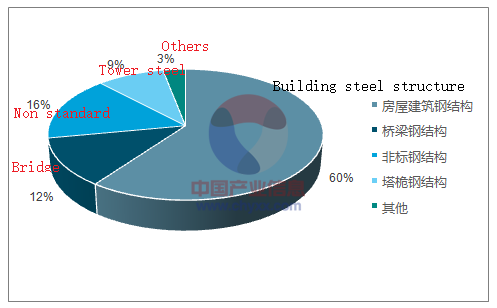

Chart 1:Application and distribution of steel structure in 2015

2 Prefabricated construction market having huge space.

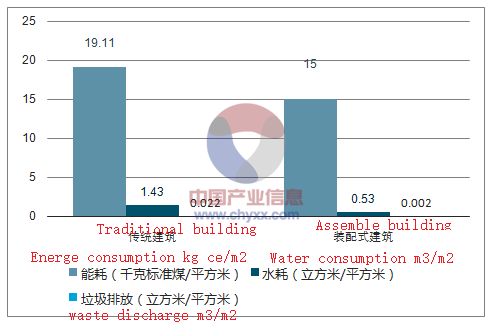

The advantages of the prefabricated building are obvious, and the industry has higher growth. The prefabricated buildings consist of concrete prefabricated buildings and steel prefabricated buildings. The core of the prefabricated building is that all parts are pre manufactured in the factory, it refers to the construction of buildings by means of industrialized production, in which all parts and components are prefabricated in factories, and then transported to the construction site, and the components are assembled by reliable connection. From the point of view of environmental protection, assembled buildings can significantly save water, save energy and reduce garbage emissions. Energy consumption is reduced from 19.11 kg standard coal/m2 to 15 kg standard coal/m2, water consumption is reduced from 1.43 m3/m2 to 0.53 m3/m2, and garbage discharge is reduced from 0.022m3/m2 to 0.002 m3/m2, a drop by 91%. Therefore, from the perspective of environmental protection, assembly building has become the first choice for the development of modern green building. With the construction of new cities, prefabricated buildings will be promoted comprehensively in China, which will bring new profit growth and development opportunities to Chinese steel structure manufacturers.

Chart 2:Advantages of prefabricated building

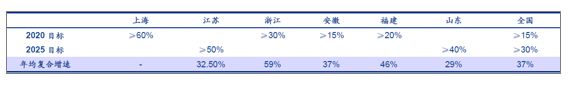

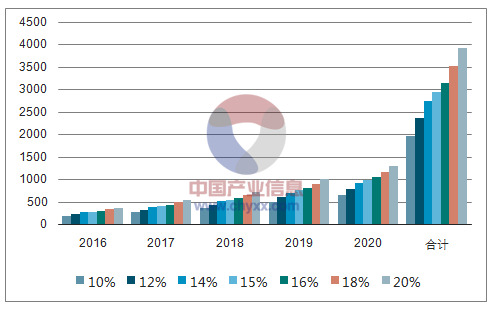

In the State Council's "Some Opinions on Further Strengthening the Management of Urban Planning and Construction" in 2016, it is pointed out that it is expected to take about 10 years to make the prefabricated buildings account for 30% of the newly-built buildings. In March 2017, the Ministry of Housing and Construction's "Thirteenth Five-Year Plan of Action for Assembly Buildings" requires that by 2020, the proportion of assembly buildings in new buildings in China will reach more than 15%. The number of key areas to be promoted will be over 20%, the number of areas to be promoted will be over 15%, and the number of areas to be promoted will be over 10%. According to statistics, in 2015, the newly built prefabricated buildings in China covered an area of 3500-45 million square meters, with a total area of 1544.54 million square meters, accounting for less than 3% of the total. It is necessary to increase by 37% annually to reach the target of 15% by 2020, and the market space is huge. At the same time, all provinces have also issued the 5 year plan for the development of fabricated buildings. Hangzhou-Xiaoshan Steel Structure (one of the largest steel structure manufacturers in China) has 40% of its business in eastern China. Taking six provinces in eastern China as an example, the governments have formulated clear development goals. It is estimated that the annual growth rates of each province in the next few years are 32.5% in Jiangsu, 59% in Zhejiang, 37% in Anhui, 46% in Fujian, 29% in Shandong and 37% in China

Chart 3:Target and growth rate of prefabricated buildings in East China

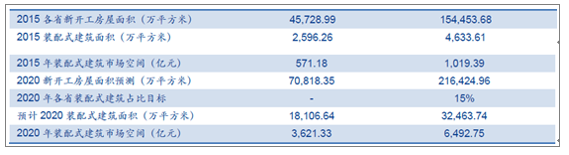

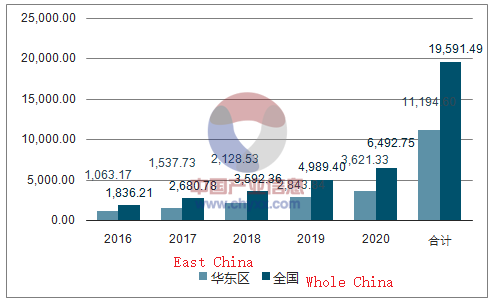

In the year of 2016-2020, there are trillions of space increments in China's prefabricated construction market, which has broad market prospects.

The total output value of the prefabricated construction market in East China in 2015 is about 57.118 billion yuan, and it will reach 36.233 billion yuan by 2020. If the proportion of steel structure assembled buildings is 20%, the output value of steel structure will reach 72 billion yuan, and the increase of market space will reach 1.12 trillion yuan in the five years from 2016 to 2020. The market space of assembly construction in 2015 is about 101.939 billion yuan. By 2020, the market space will reach 649.275 billion yuan, and the total market output value will increase by 1.12 trillion yuan in 2016-2020. It can be seen that steel structure assembly building will be a new highlight and profit growth point of steel bond manufacturing, and will bring considerable orders and business increment to Chinese steel structure manufacturers.

Chart 4:Estimation of output value of fabricated buildings in East China and the whole country in 2016-2020 years (unit: 100 million yuan)

Chart 5:Estimation of output value of fabricated buildings in East China's provinces in 2016-2020 years (unit: 100 million yuan)

Steel prefabricated buildings account for about 15% of the total prefabricated building market, with a total increase of nearly 300 billion yuan. Steel prefabricated buildings include concrete prefabricated buildings and steel prefabricated buildings ,experts predict that the market share of steel prefabricated buildings will reach 10%-20%. According to our calculations, the market space growth of China's prefabricated buildings in 2016-2020 is 183.6 billion yuan, 268.1 billion yuan, 359.2 billion yuan, 498.9 billion yuan, and 649.3 billion yuan, respectively; According to the 20% market share of steel structure assembly construction in total prefabricated construction, the market space of steel structure assembly construction in China from 2016 to 2020 is 36.724 billion yuan, 53.616 billion yuan, 71.847 billion yuan, 99.788 billion yuan and 129.855 billion yuan respectively, with a total increase of 39.183 billion yuan in 5 years. Taking 15% of the median, the market space for steel structure assembly in China from 2016 to 2020 is 27.543 billion yuan, 402.12 billion yuan, 53.885 billion yuan, 74.841 billion yuan and 97.391 billion yuan, respectively, with a total increase of 293.872 billion yuan in 5 years. This will bring considerable profits and development opportunities to China's steel structure manufacturing enterprises.

Chart 6:Spatial sensitivity analysis of steel structure assembly building market in China

3 Analysis of the development trend of Chinese steel structure market

In the future, steel structure will grow at a higher rate, mainly from housing construction. In 2015, the output of China's steel structure is only 50 million tons. The average annual growth rate of the steel structure industry needs to reach more than 12% to achieve the target of 8000 tons, and the average annual growth rate can reach more than 20% to reach the target of 100 million tons. Steel structure in China is mainly used in Housing steel structure, bridge steel structure, non-standard steel structure and tower mast. According to the statistics of the Steel Structure Branch, in 2015, the steel structure of housing construction accounted for the highest proportion of the overall steel structure, about 60%, followed by the bridge steel structure, accounting for 12%, non-standard steel structure accounted for 16%, the lowest proportion was the tower mast steel structure, accounting for 9%. Therefore, we believe that the main increment of steel structure comes from the application of building steel structure. China's steel structure industry will usher in a period of high-speed development in 2017 after the previous market downturn and intra-industry competition.